39+ how do biweekly mortgage payments work

Lets say you have a. Ad See If Youre Eligible for a 0 Down Payment.

Why You Should Consider Making Biweekly Mortgage Payments Vs Monthly Hassle Free Savings

Web A 1000 annual payment would cost you 12000 total.

. Or save that amount every month for. Web A biweekly mortgage payment plan involves making half of that mortgage payment or 104750 every two weeks for a total of 26 payments each year. Web Biweekly Mortgage Payments Vs.

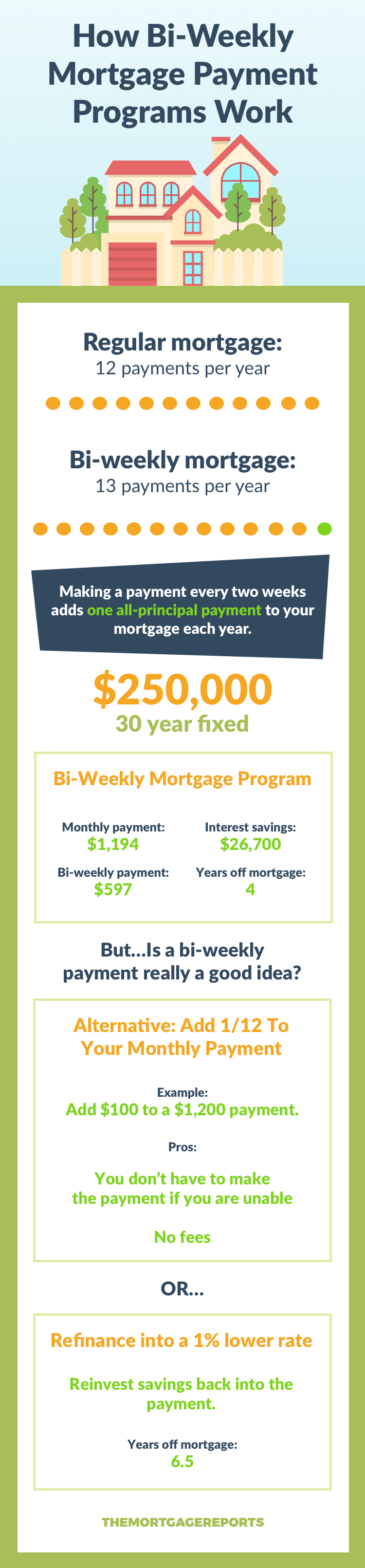

If you used to pay 1200 dollars a month youll pay 600 every two weeks instead. Web On a biweekly schedule youll have two calendar months in which you end up making three payments. Biweekly payments are equal to 13 monthly payments in a year where making traditional monthly payments are.

Ad Increasing Mortgage Payments Could Help You Save on Interest. Web Biweekly payments mean you pay off your loan 4 years and 3 months early by making the equivalent of one extra payment per year. Total interest paid drops by nearly 30000 to.

For the rest of the time youll make only two payments per. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Web Bi-weekly Mortgage.

M P. Simply take your normal monthly mortgage. Our P or principal is 400000.

Web The biggest benefit of paying every two weeks is that it essentially means youre making an extra payment every year. Compare More Than Just Rates. Browse Information at NerdWallet.

Ad Compare the Best Home Loans for February 2023. Web When you change to biweekly payments youll make payments every two weeks. Web The biweekly method drastically decreases the amount of interest you pay for your home.

Many homeowners choose to pay biweekly instead of monthly mortgage payments. Remember with i we must take the annual interest rate given to us 35 or. Web When you make biweekly mortgage payments you ultimately end up making 26 half payments or 13 full payments throughout the year.

Web If the math is a little tough to follow it works like this. These savings will accumulate and over the next 30 years youd pay about 165000 in interest making 12 mortgage payments per year. Paying every two weeks equals 13 months.

Web By switching to an accelerated bi-weekly mortgage payment you would pay 124095 in interest and will have the mortgage paid off in 22 years. So in this example. Biweekly payments of 500.

You would spend 17371781 on interest alone throughout the course of the loans duration. Web By making biweekly mortgage payments you will lower your loans principal balance slightly more. Ad Learn More About Mortgage Preapproval.

Apply Get Pre-Approved Today. A mortgage payment plan where payments are made every two weeks as opposed to the more traditional monthly payment plan. Lock Your Rate Today.

Web For quick reference again the formula is. Thats 26 half payments a year or the equivalent of. Make just one extra payment per year and heres what happens.

Find A Lender That Offers Great Service. Get Instantly Matched With Your Ideal Mortgage Lender. If you take 500 and multiply it by 26 payments you have 13000 in total.

Web Instead of having a biweekly mortgage company handle your monthly payment for a fee or having to make 26 payments a year. Web Take your monthly mortgage payment and divide it by 12. Web How biweekly mortgage payments work When you pay your mortgage biweekly you pay half of your monthly principal and interest every two weeks.

Calculate Your Monthly Loan Payment. Answer Simple Questions See Personalized Results with our VA Loan Calculator. Web If you pay biweekly youll make half of your monthly principal and interest payment every two weeks instead.

Save Thousands Not only will. Make an extra principal-only payment of that amount every month.

How Do You Make Biweekly Payments On A Mortgage Youtube

How To Pay Your Mortgage Biweekly 9 Steps With Pictures

Mortgage Due Dates 101 Is There Really A Grace Period

How Do Bi Weekly Mortgage Payments Work The Home Mortgage Pro Blog

How Do Bi Weekly Mortgage Payments Work The Home Mortgage Pro Blog

Biweekly Vs Monthly Mortgage Payments What To Know Chase

Bi Weekly Mortgage Program Are They Even Worth It

Biweekly Payments Mortgage Calculator Nerdwallet

Biweekly Mortgage Payments An Easy Trick To Do Them For Free

Biweekly Mortgage Calculator How Much Will You Save

Why You Should Consider Making Biweekly Mortgage Payments Vs Monthly Hassle Free Savings

Bi Weekly Mortgage Payments Explained Youtube

Remote Angular Jobs With Great Benefits And Pay

Determining Mortgage Payments Frequency Options

39 Samples Of Stub Templates

Bi Weekly Mortgage Program Are They Even Worth It

Biweekly Vs Monthly Mortgage Payments What To Know Chase